Choosing Your Denver Uninsured and Underinsured Motorist Lawyer

In Colorado, the law requires all motorists to carry adequate car insurance. Drivers must maintain at least $25,000 in coverage for bodily injury per person and $50,000 per accident, as well as $15,000 in property damage liability. Unfortunately, some drivers evade this expense by driving without insurance or with below minimum requirements of insurance. In fact, uninsured driving is a big enough issue that insurance companies offer specific coverage just for uninsured/underinsured driver collisions. This is an optional, additional type of insurance coverage in Colorado.

If you discover the driver who caused your accident does not have enough insurance to cover your damages, don’t panic. Your own insurance company might step in to take care of your medical bills and property damage. Your other potential legal remedy is a personal injury lawsuit. Jordan Law can help you file this type of claim in pursuit of full compensation through the Colorado civil system. Talk to our Car accident lawyer in Denver for more information.

For a free legal consultation with an uninsured and underinsured motorist lawyer serving Denver, call (303) 465-8733

About Uninsured/Underinsured Motorist Insurance

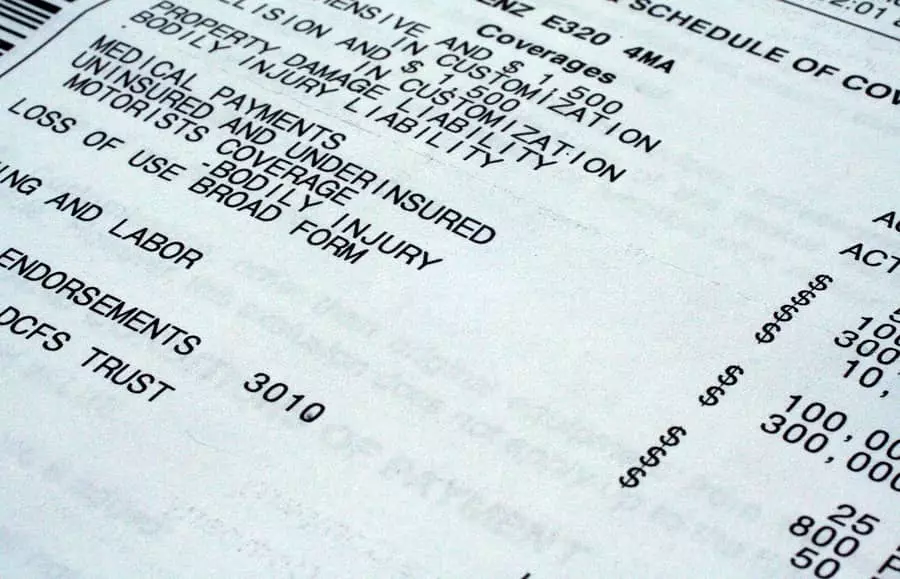

By law, insurance companies must offer uninsured/underinsured motorist (UM/UIM) coverage in the same amounts as your selected bodily injury liability limits. Colorado drivers can legally reject this type of optional coverage, but they must do so in writing. If you never wrote or gave your signature to reject UM/UIM coverage, odds are you have these benefits on your policy. Review your policy or call your agent and ask if you have this type of insurance in the event of an accident with an uninsured motorist.

By law, insurance companies must offer uninsured/underinsured motorist (UM/UIM) coverage in the same amounts as your selected bodily injury liability limits. Colorado drivers can legally reject this type of optional coverage, but they must do so in writing. If you never wrote or gave your signature to reject UM/UIM coverage, odds are you have these benefits on your policy. Review your policy or call your agent and ask if you have this type of insurance in the event of an accident with an uninsured motorist.

Colorado is a “fault” car insurance state. This means that injured parties will file claims with the at-fault driver’s insurer. UM and UIM coverage provides medical benefits and extends to other losses should the at-fault driver not have enough insurance to cover your damages. If the other driver has insurance, but not enough, his/her policy will cover what it can, and then your UM/UIM coverage will take care of the rest. UM/UIM coverage can also kick in after a hit-and-run accident, where the at-fault driver does not stay to exchange information.

After an accident with an uninsured or underinsured driver, call your own insurance company and explain that you need to file a UM/UIM claim. Your agent will walk you through the steps if you have this type of coverage, and you should receive a check soon after completing the claims process. Your plan should cover your medical bills and property damage, depending on the limits you purchased. You will only run into problems if you waived UM/UIM coverage or if this coverage still isn’t enough to reimburse your damages.

Our Colorado Location

Denver Uninsured And Underinsured Motorist Lawyer Near Me (303) 465-8733