If you’ve been in an accident and someone else is at fault, your insurance company might pay for your medical bills or car repairs. But what happens next? This is where “subrogation” comes into play.

What Is Subrogation?

Subrogation is a big word that means your insurance company can get back the money it paid for your bills from the person who caused the accident. It’s like your insurance company is saying, “We took care of you, now it’s time for the person responsible to pay us back.”

For a free legal consultation, call (303) 465-8733

How Does Subrogation Work?

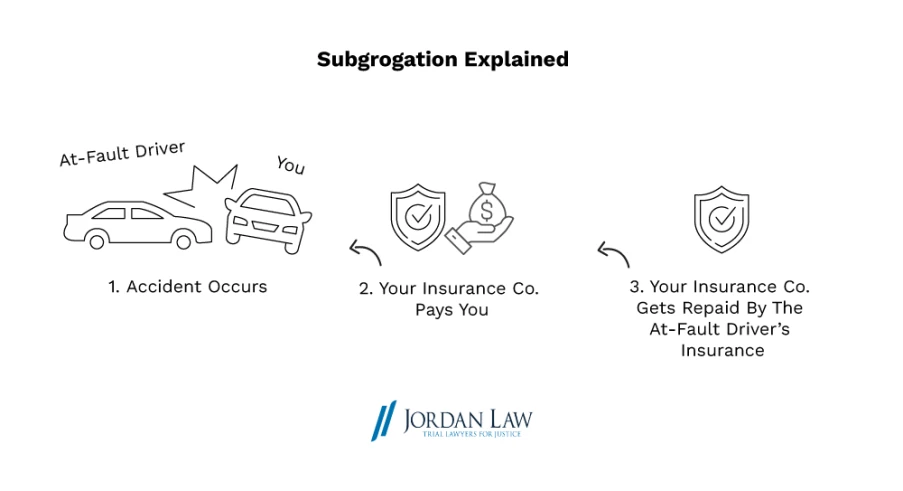

Here’s how it works:

- Accident Happens: Let’s say you’re in a car accident, and it’s not your fault.

- Insurance Pays: Your insurance company steps in and pays for your car repairs or medical bills so you can get back on your feet quickly.

- Subrogation Starts: After paying, your insurance company looks at who caused the accident. If it’s someone else, they might ask that person’s insurance company to pay them back. This is subrogation.

- You Get Reimbursed: If your insurance company gets the money back, you might get reimbursed for your deductible, which is the amount you paid out of pocket.

Why Is Subrogation Important?

Subrogation helps keep insurance costs down. If your insurance company didn’t get the money back from the at-fault person, they might have to raise premiums (the amount you pay for insurance). By using subrogation, your insurance company helps make sure that the right person pays for the accident.

What Should You Do?

If you’re in an accident, it’s important to:

- Report the Accident: Tell your insurance company as soon as possible.

- Keep Records: Save all your bills and receipts related to the accident.

- Understand Your Policy: Know what your insurance covers and how subrogation might affect you.

Conclusion

Subrogation might sound complicated, but it’s really just a way for insurance companies to get back the money they paid out when someone else is at fault. By understanding subrogation, you can be better prepared in case you’re ever in an accident. Remember, your insurance company is there to help, and subrogation is one way they make sure the right person pays.